At CLMT, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. CLMT's material environmental, social and governance (ESG) factors are aligned with CapitaLand Investment 2030 Sustainability Master Plan (SMP), which was refreshed in 2023 as part of the review by the Board of the Manager of CLMT together with Management.

The CapitaLand 2030 Sustainability Master Plan steers our efforts on a common course to maximise impact through building portfolio resilience and resource efficiency, enabling thriving and future-adaptive communities, and stewarding responsible business conduct and governance. Ambitious ESG targets have been set by CLI and adopted throughout the organisation, including CLMT. These targets include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi).

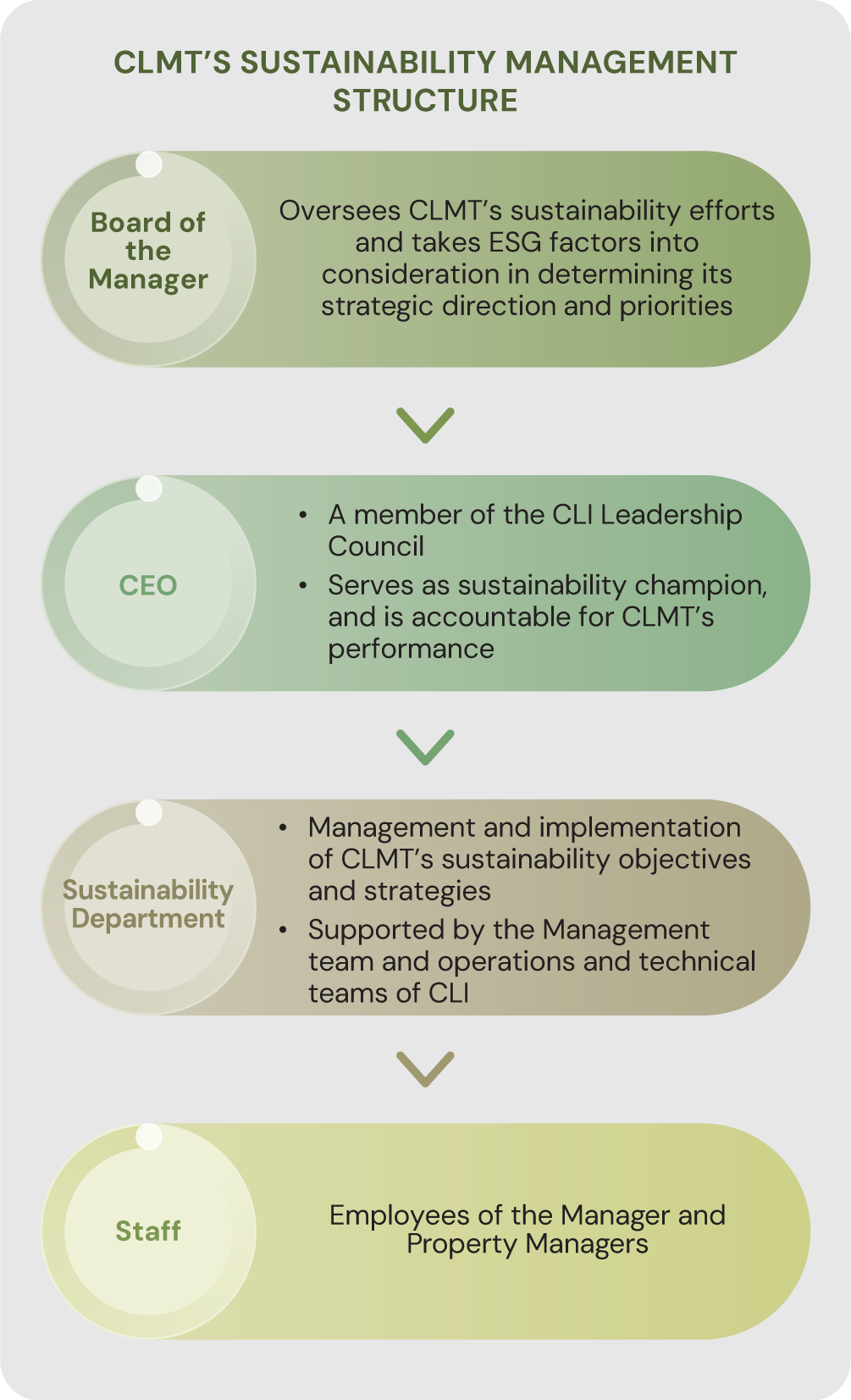

The Board of the Manager of CLMT is responsible for overseeing CLMT's sustainability efforts, and takes ESG factors into consideration in determining its strategic direction and priorities. The Board also approves the executive compensation framework based on the principle of linking pay to performance. The Manager's business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices and are cascaded throughout the organisation.

CLMT's sustainability performance has been globally recognised by leading sustainability benchmarks such as GRESB. CLMT will continue to identify and adopt meaningful ESG practices and enhance sustainability in the real estate sector.

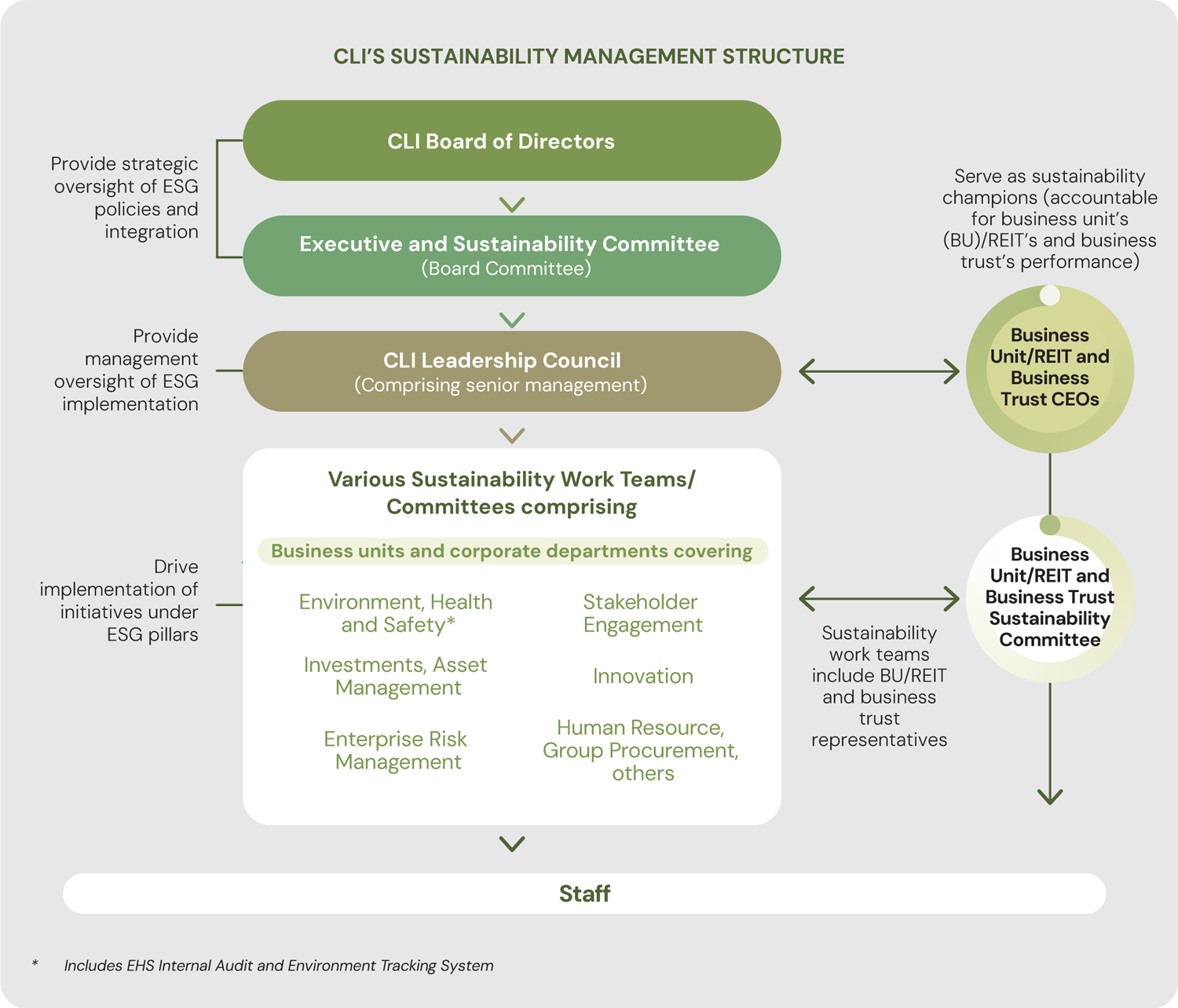

CLI's group-wide sustainability management is under the purview of a CLI Board Committee - the Executive and Sustainability Committee (ESC), previously known as Strategy and Sustainability Committee, that is chaired by a Lead Independent Director. The CLI ESC is responsible for overseeing CLI's sustainability strategies and goals, including providing guidance to management and monitoring progress against achieving the goals of sustainability initiatives. The CLI ESC is supported by the CLI Group Sustainability department and the various work teams to drive continued progress and improvement in ESG. The work teams comprise representatives from various CLI business units and corporate functions. Each business unit has its own Environmental, Health and Safety (EHS) Committee to drive initiatives in countries where it operates with support from various departments.

The Board of the Manager considers sustainability issues as part of CLMT's strategic formulation, confirms the material ESG issues listed by the Manager and oversees the management and monitoring of the material ESG factors. The Board of the Manager determines CLMT's risk appetite, which guides the nature and extent of material risks that CLMT is willing to take to achieve its strategic and business objectives. The Manager conducts an annual Risk and Control Self-Assessment (RCSA) to assess and document ESG-relevant material risks. As part of the material risk issues being highlighted, climate change has been identified as critical. The Board is actively involved in discussions on climate-related initiatives and regularly reviews climate change risks as part of its Enterprise Risk Management (ERM) Framework.

The update to the Board is conducted at the quarterly Board meetings and covers relevant climate-related topics, green capital expenditure plan, green ratings of properties, and performance metrics such as carbon emissions performance, progress on the reduction targets, as well as stakeholders' expectations on climate change. Any environmental incidents, which may include climate-related damages or disruptions, are also reported to the Board. As environmental impact factors are considered as part of the asset investment evaluation process and strategy, these are brought to the Board's attention when relevant.

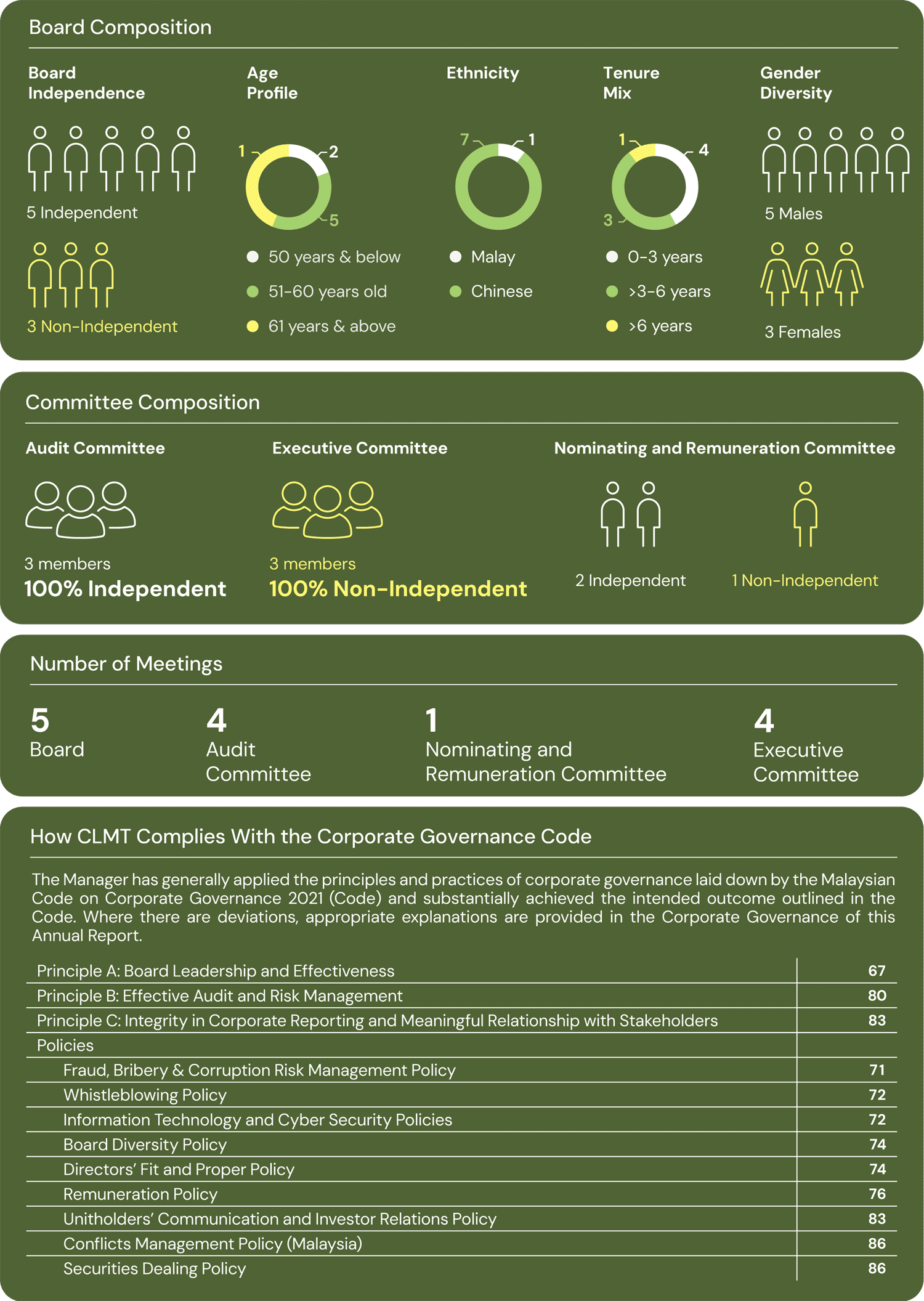

On 6 June 2023, the Securities Commission Malaysia and Bursa Malaysia rolled out of a new mandatory onboarding programme on sustainability for directors of Public Listed Companies on Bursa Malaysia. The Mandatory Accreditation Programme (MAP) Part II: Leading for Impact (LIP) is an extension to the existing MAP, now known as MAP Part I under the Bursa Malaysia Main Market Listing Requirements. As at 31 December 2024, all directors of the Board of the Manager, save for the newly appointed Datin Hayati Aman Binti Hashim, have completed MAP Part I and II.

A Sustainability department led by the CEO of the Manager oversees sustainability objectives and strategies directly to ensure greater focus on sustainability and climaterelated matters for CLMT. The Sustainability Department is responsible for providing timely and regular updates on CLMT's sustainability matters and progress report on 2030 SMP to the Board of the Manager.

These updates are in relation to sustainability risks, and relevant performance metrics, which include carbon emissions performance, progress on achieving the reduction targets, green certification, human capital development, as well as stakeholders' expectations on climate change and/ or other social matters. The Sustainability Department works closely with key members from various departments including finance, investment and portfolio management, as well as operations department and technical teams of CLI in carrying out strategies and relevant activities, abiding by CLI's sustainability framework and policies. The Property Managers have an EHS Committee and an Engineering, Systems and Sustainability team whose role includes integrating sustainability into operations.

The Board of the Manager embraces diversity and has in place a Board Diversity Policy which provides for the Board to comprise talented and dedicated Directors with a diverse mix of expertise (including industry, domain and functional expertise), skills, experience and perspectives, with due consideration to diversity factors, including but not limited to, gender, age, ethnicity and professional background.

With respect to female representation, the Board's Nominating and Remuneration Committee (NRC) notes the Malaysian Code on Corporate Governance (MCCG) 2021 target of women making up 30% of the boards and Bursa Malaysia's requirement for all public listed companies to appoint at least one women director. In its annual review of the Board's composition, the NRC expressly considers and includes a commentary to the Board about diversity in the composition of the Board. As at 31 December 2024, women representation on the Board of CMRM stood at 37%, exceeding the MCCG 2021 target, and this progress underscored the Board's commitment to fostering gender diversity.

As a CLI-sponsored REIT, CLMT's material ESG issues and the value created, aligned to CLI's 2030 SMP focus areas and commitments, are mapped to the International Integrated Reporting Commission (IIRC) Framework's six integrated reporting Capitals - Environmental, Manufactured, Human, Social and Relationship, Organisational, and Financial. This is further mapped against eight UN SDGs that are most aligned with CLI's 2030 SMP focus areas, and where CLI and CLMT can achieve the greatest positive impact.

The UN SDGs call on companies everywhere to advance sustainable development through the investments they make, the solutions they develop, and the business practices they adopt. In doing so, the goals encourage companies to reduce their negative impacts while enhancing their positive contributions to the sustainable development agenda.

| Our Commitments | 2024 Value Created | |

|---|---|---|

Environment

|

For CLMT:

|

Environmental Capital

Manufactured Capital

|

Social

|

For CLMT:

|

Human Capital

Social and Relationship Capital Manufactured Capital

|

Governance

|

For CLMT:

|

Organisational Capital

Human Capital

|

Economic

|

For CLMT:

|

Financial Capital |

As a CLI-sponsored REIT, CLMT identifies and prioritises the management of material ESG issues that are most relevant and significant to the REIT and its stakeholders. It adopts a double materiality approach, considering issues which are material from either the impact perspective or financial perspective or both.

In 2024, CLI revalidated its ESG factors materiality with two key ESG surveys, namely DJSI and GRESB. It also referenced ESG standards and frameworks including (i) GRI standards and SASBi standards for real estate owners/developers and investment trust, (ii) International Sustainability Standards Board (ISSB) Standards (S1 and S2), (iii) UN Global Compact (10 Principles) & UN Principles for Responsible Investment (CLI is a signatory); and (iv) SGX Core ESG metrics and EU Sustainable Finance Disclosure Regulation (SFDR) questionnaire key topics.

Pursuant to the ESG factor materiality review exercise for CLI, including its listed REITs and business trusts, no changes were recommended to its ESG material issues after mapping against key ESG surveys (GRESB, DJSI), other standards/ frameworks and investor surveys.

As a CLI-sponsored REIT, CLMT is guided by CLI's materiality assessment process, where the Manager conducts regular reviews, assessments and feedback in relation to ESG topics. Potentially material ESG issues arising from activities across CLMT's value chain (including potential risks and opportunities in the immediate and longer term) are primarily identified via ongoing engagement with CLMT's external stakeholders, and reviews of sources including investor questionnaires, as well as ESG surveys, sustainability benchmarks and frameworks such as GRESB.

Identified material issues are reported in CLMT's corporate risk register through the annual Group-wide Risk and Control Self-Assessment (RCSA) exercise, which identifies, assesses and documents material risks and the corresponding internal controls to manage those risks. These material risks include fraud and corruption, environmental (e.g. climate change), health and safety, and human capital risks which are ESG-relevant. Identified material ESG issues are then prioritised based on the likelihood and potential impact of issues affecting the business continuity of CLMT. For external stakeholders, priority is given to issues important to the community and applicable to CLMT. In FY 2024, the material ESG topics that were identified were approved by the Board of the Manager for their continued relevance. For more information on CLMT's ERM and the Group-wide RCSA exercise, please refer to the Risk Management section on page 96 to 100 of CLMT AR 2024.

| Critical | Moderate and Emerging | |

|---|---|---|

| ENVIRONMENT |

|

|

| SOCIAL |

|

|

| GOVERNANCE |

|

(Note: indicators like Economic Performance, Market Presence and Governance are not included as they are assumed to be material for all companies. Economic Performance/Market Presence have been challenged by external parties for not being ESG indicators, and thus not included as a factor)

CLMT recognises the risks that climate change can have on its portfolio and the opportunities arising from it. It aims to better understand and respond to physical risks, such as extreme weather events and rising temperature, as well as transition risks towards a low-carbon economy. Aligned with its Sponsor, CLMT is focused on low-carbon transition to mitigate transition risks, and on climate change adaption to build portfolio resilience against the physical risks from climate change.

In support of the recommendations by the TCFD, CLMT has published climate-related financial disclosures in four key areas (i. governance, ii. strategy, iii. risk management, and iv. metrics and targets) since 2021 as recommended by the TCFD.

As part of the 2030 SMP formulation, CLMT generally considers medium-term time frames to be until 2030, and long-term beyond 2030 in relation to the identification of climate-related risks and opportunities.

In 2023, CLI and its REITs, including CLMT, completed its climate scenario analysis for its global portfolio to understand how the identified climate-related risks and opportunities could impact future operations. The insights on both quantitative and qualitative assessments of the risks identified provide a basis for the next steps in understanding the severity of risk impacts across time horizons. CLI and its REITs, including CLMT, will continue to review their mitigation and adaptation plans and identify opportunities that align with CLI's 2030 SMP.

For full 2024 Sustainability Statement, please click here.

For CapitaLand Investment's Global Sustainability Report 2024, please click here.